VALUING LIFE ESTATES

by Mason Spurgeon, Certified General Real Estate Appraiser

February 2017

One of the common misconceptions about farm real estate appraisers is that our valuations are strictly concerned with real estate: acreage, location, buildings, soil types, and so forth. This conception is true in most cases. However, another important factor for farm appraisal work concerns cases of co-ownership. When a farm property is co-owned according to some special agreement, any market buyer will realize that he can only purchase the farm “with strings attached.” This affects how much he is willing to pay for that property. And since appraised values are meant to reflect market values, appraisers must account for these forms of co-ownership.

One such example is the life estate. A life estate is an agreement whereby an individual’s interest in real estate is limited to that individual’s lifetime, with the property passing to other recipients at the individual’s death. The creation of a life estate divides the fee simple estate into two lesser estates held by the “life tenant” and the “remainderman.” The person who holds the life estate is called the life tenant, and those who receive the property at the death of the life tenant are called remaindermen.

The life tenant will have some specified right to use, occupy, and control the farm property under the life estate until the life tenant passes away, at which time the life estate is terminated. The remaindermen is then in control of the fee simple interest of the farm property, the full bundle of rights, and will have the total right to use, occupy, and control the property. Typically, someone who wants to ensure that the transfer of their farm property is smooth after their death will sell or gift the land to another person, but retain a life estate. Life estates in our market area are usually formed between family members.

Many life estates apply to the entire farm property, and the life tenant retains all the income from the farm and the use of the buildings, and lives in the home. However, some life estates are only applicable to the home and a few acres on a larger farm. This is good for the remainderman, who can now use the farm ground and/or other parts of the tract to help pay the life tenant for the property, while the life tenant can remain in the home.

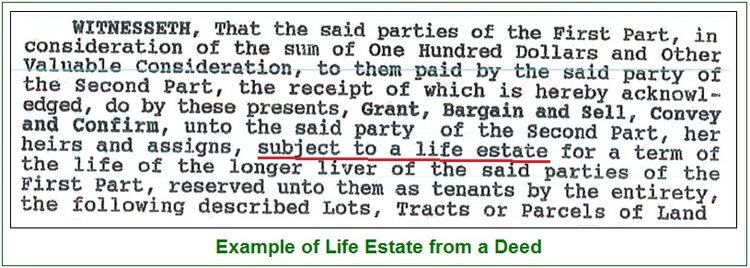

The existence of a life estate is usually listed in a deed near the legal description. For this reason, we always ask for a legal description or deed for the subject property we are appraising. These documents need to be reviewed with careful attention to detail. Every life estate is written differently depending on the lawyer and the life tenant’s wishes.

Developing an opinion of value for a property with a life estate can be challenging for farm appraisers. These arrangements must be viewed through the eyes of the market to determine how a potential buyer would pay for a property with such an agreement. However, at Spurgeon Appraisals, we are experienced at appraising these kinds of properties. If you have questions about valuing your life estate, please do not hesitate to call us. Our customer service is second to none.

Spurgeon Appraisals regularly appraises a variety of property types. We have experience appraising farms, residences, and commercial properties. We pride ourselves on providing excellent customer service and quality appraisals. Contact our team to see how we can meet your appraisal needs and exceed your service expectations.